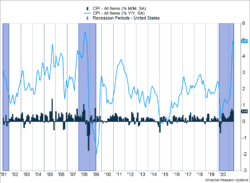

U.S. consumer prices continued to go up faster than normal. The Consumer Price Index (CPI) jumped 0.6% last month and has now increased 5.0% over last year (Figure 1). Used car and truck prices rose 7.3% last month and are 29.7% higher over the last year. New car prices increased 1.6%, and airline fares surged 7.0%.

Key Points for the Week

- S. consumer prices rose 0.6% last month, and the one-year inflation rate accelerated to 5.0%.

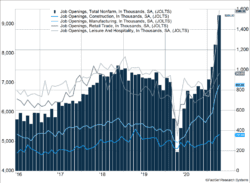

- S. job openings reached an all-time high of 9.3 million as employers anxiously attempted to fill openings as the economy expands.

- Chinese imports and exports rose 51.1% and 27.9% respectively, as global trade indicated activity is making up for last year’s slowdown.

Job openings also jumped and reached an all-time high of 9.3 million as employers continued to be anxious for employees to return to their jobs. Employees haven’t responded as quickly as employers would like. Openings in the leisure and hospitality industry rose 400,000 to an incredible 1.6 million as more restaurants are reopening to indoor dining and finding workers has proven difficult (Figure 2).

Stocks and bonds rallied last week as the jump in inflation was viewed as more likely to be a short-term challenge. The S&P 500 gained 0.4%. The MSCI ACWI Index added 0.4%. The Bloomberg BarCap Aggregate Bond Index leapt 0.5%.

Retail sales will be the top focus this week. The U.S and China will report consumer spending as well as industrial production. A number of countries report consumer price data, which we’ll be examining for signs of inflation pressure in countries that have been slower to return to growth.

Figure 1

Figure 2

Anyone Want to Interview?

There are signs of temporary labor and supply shortages in the U.S. economy and an underlying confidence those shortages will prove temporary. Labor shortages during a period of rehiring resulted in 9.3 million open jobs, an all-time record. Many of the new openings were at restaurants, hotels, and entertainment venues. The leisure and hospitality industry has 1.6 million openings, 400,000 more than last month.

The growing number of openings and lower-than-expected employment gains (see last week’s update) indicate industries are reopening faster than workers are desiring to return to work. The large increase in openings can be due to several factors. Heightened unemployment benefits and other pandemic aid are likely contributors. So are a mismatch in location, as the Midwest has recovered more quickly and the unemployed are more often located on the coasts.

A decline in the number of people wanting to work has also affected rehiring. Some people have likely decided not to return to work. Jobs that may have been filled by part-time workers in the past are going empty, and some people who used to work more than one job have decided their improved financial situation means they can get by on one.

The shortages are also showing up in consumer prices. The CPI gained 0.6% and is now up 5.0% over the last year. Often big jumps in inflation are because of swings in energy or food prices. Both of these often-volatile elements registered lower price increases than the overall index. Energy prices were flat, and food prices rose 0.4% compared to last month.

Instead, the biggest price gains were in items tied to moving around. The shortage of semiconductors has reduced the number of automobiles being produced. A lasting influence of COVID is likely wider vehicle ownership. Those two factors have collided to push used vehicle prices 7.3% higher last month and 29.7% over the last year. New vehicle prices gained 1.6% last month.

In addition to buying more vehicles, people are flying more. Last Friday, the TSA reported more than 2 million screenings. It was the first time the number of screenings had topped 2 million since the pandemic began. A jump in demand often is reflected in prices, and last month was no exception as airfares rose 7.0%.

Market reaction to higher-than-expected inflation was fairly positive. Because the sectors experiencing the biggest price increases were affected by shortages or price hikes to manage surging demand, concerns about a broad inflationary increase declined. While prices are surging now, they are only 2.5% higher than two years ago. As supply challenges are resolved or surging demand for automobiles slows slightly, we expect inflation to settle between 2% and 3% — higher than in the past, but far short of the destabilizing inflation experienced during the 1970s.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.wsj.com/articles/us-inflation-consumer-price-index-may-2021-11623288303

https://www.bls.gov/news.release/laus.nr0.htm

https://www.bls.gov/news.release/jolts.nr0.htm

https://www.bls.gov/news.release/cpi.nr0.htm

Compliance Case #01057770